“If you want to be a performance basketball brand, you gotta have NBA players playing in your shoes,” Matt Powell says matter-of-factly. The senior sports advisor for The NPD Group isn’t being sarcastic. It’s the most obvious reason for the recent splurge by Puma in the basketball space. But there’s a lot more going on beneath the surface of a splashy signing.

Midway through June, Puma shocked the basketball world when it inked Marvin Bagley III, the No. 2 pick in the NBA Draft, to the largest rookie sneaker deal in over a decade.

For some perspective, the last time the German-based company signed an NBA player, the Y2K bug had America shook. It feels quaint in retrospect, but Puma’s 1998 agreement with Vince Carter—in the penultimate Vinsanity years—ended in a lawsuit, and the then-Raptors star went with Nike right after Y2K turned out to be overwrought hysteria. Two decades have passed with Puma sitting on the NBA sidelines as Nike, Adidas, and more recently Under Armour jockeyed for a larger slice of the market.

After Bagley signed his deal, a contract followed for the No. 1 pick, DeAndre Ayton, and it was reportedly even more than the one for Bagley. Then came two smaller deals for lottery hopefuls Michael Porter Jr. and Zhaire Smith. The brand also signed veteran Rudy Gay. However, those weren’t the only big moves Puma announced during draft week.

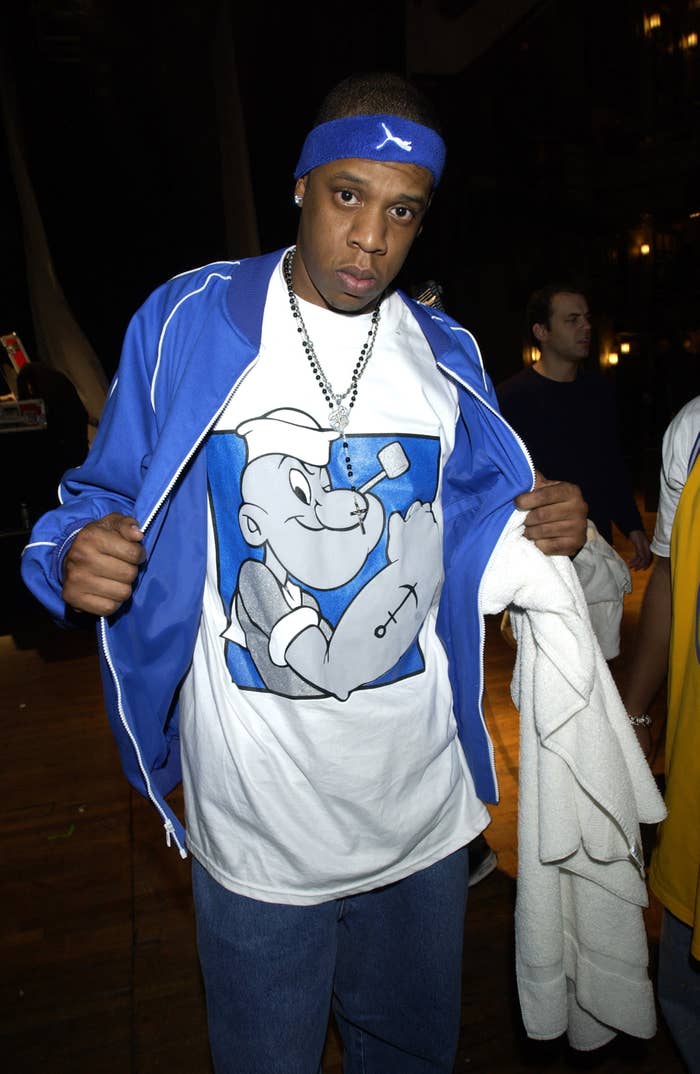

Loquacious former Knick, current MSG Network color man, and the first NBA player Puma partnered with in the 1970s, Walt “Clyde” Frazier, accepted a lifetime contract the same day they announced JAY-Z would be Puma basketball’s new creative consultant. (JAY has cachet, but Bagley didn’t find that out about him until later). When the 2018 Draft finally popped off later that same week, Ayton and Bagley were selected as the first two picks.

All of this begs the question: In a space where there are already two major players, Nike and Adidas, with an upstart that’s cooled off, Under Armour, what is Puma trying to accomplish? Why give such gaudy deals to unproven rookies? Even highly-touted rookies are a risk.

“It’s a crapshoot,” says Powell when discussing last year’s largely disappointing rookie seasons for Markelle Fultz and Lonzo Ball. “It really is.”

What felt like a shock to the system for many sneakerheads, was months of planning for Puma. They say JAY-Z has been with them since before they locked up Bagley or Ayton, and they’ve been coordinating the jump back into basketball for a while.

“We have been working on our re-entry into the category for about a year,” says Adam Petrick, Global Director of Brand and Marketing for Puma. “We began working with Jay-Z long before we began signing players.”

If you want to understand what Puma is trying to do, you first have to appreciate where the performance basketball marketplace is today. The cachet of a signature athlete isn’t what it once was, and old ways of doing business—large endorsement deals from the celebrity of the moment—haven’t seen the returns brands want.

“The basketball business is challenged now,” Powell admits, “and market share is definitely up for grabs.”

Corey Leff, founder of sports business newsletter John Wall Street, confirmed as much in an email: “U.S. performance basketball sneaker sales are down 13 percent from their 2015 high of $1.3 billion.”

While that makes Puma’s decision seem more confounding, the company claims it’s an advantageous condition to tilt the space in their favor. “We felt that the market circumstances were right, that the category needed a shakeup,” says Petrick.

But with most of the top brands bleeding money they’ve spent on celebrity athlete endorsements, why make such an expensive, high-risk play for market share? Part of the answer stems from their success as a sportswear brand.

“Puma has never established itself as a performance brand in the United States,” Powell says. “They’ve always been the sportswear brand, and their business is playing good right now, because we’re in a very heavy sportswear cycle.”

It’s the right landscape for them to dive back into basketball.

Puma recently passed Under Armour and is now third in global athletic sales, trailing only Nike and Adidas, according to Bloomberg. According to Leff, their sales increased by double-digits across all product categories and markets in the first quarter of 2018, with even more steep growth in coveted Asian markets. They’re using that development to establish themselves in a performance platform. “So, if performance comes back into fashion, they now have a legitimate story to tell,” Powell says.

Petrick says they’ve spent a lot of time evaluating “how we want to impact the performance side of the game, and how we want to be relevant to basketball culture overall.”

All of this neglects to mention the vertigo-inducing numbers reported in the Bagley deal (around $9 million a year)—with Ayton making even more. This is especially true when you consider Puma won’t even be releasing a shoe until right before the season tips, on October 1, and there’s very little belief that Nike’s preeminence in the space—over 80 percent of the market if you include Jordan brand—is in jeopardy. Then again, marketshare is a zero-sum game, and every shoe Puma sells has to come from somewhere.

“Puma would argue this is a marketing expense and not a direct merchandise expense,” Powell adds. So, there might not be a return in shoe sales, but in exposure. They’re leveraging the deals for the publicity, even though Bagley and Ayton are untested rookies without the hype of a LeBron James coming out of high school, Kevin Durant coming out of Texas, or even Luka Doncic coming over from Europe to be the fifth selection in this year’s draft.

It makes sense Petrick didn’t mention Bagley or Ayton getting their own line, but their partnership “may result in special executions of products, special editions, or limited-edition product.” That mirrors Powell’s speculation on Puma’s strategy moving forward:

“Typically, when you’re making an introduction like this, you want the shoes to sell out very quickly,” he says. “So, you make a limited number of pairs, people are excited to get a limited shoe, that creates a lot of excitement; scarcity creates demand.”

There are other factors, too. Leff believes Puma is “making headlines and buying credibility” to “make a mark in the US.” And the NBA’s fashion-forward ethos—just look at how many NBA players show up to Fashion Week in Paris and New York—is part of the allure. “Puma, which sees itself as a style brand, believes the NBA is the league that puts the biggest emphasis on fashion,” he says.

“Basketball is about more than what happens on court, the culture that surrounds the sport is very important to our consumer, especially in the US,” says Petrick. He adds that Puma is in talks with Bagley and Ayton “on products from our non-basketball categories.”

The biggest upside to the surprise signings is how much of that moolah might be tied to performance. “I have not seen the contract, but as I understand, the base of the contract is very similar to what most first-round picks are getting,” says Powell. “They’re hedging their bet by making the big money really the incentive part of the deal.”

Powell makes clear he heard this “second-hand,” and Puma wouldn’t comment on the financial particulars of any endorsement. It fits what the brand is trying to accomplish in the space while mitigating the risk.

If Bagley or Ayton hit all of their performance incentives, or at least a large chunk of them, they’ll be two of the best players in the game, and the money Puma doled out will seem prescient. If Powell is right, and they don’t hit the incentives, it’s a standard first-round rookie deal that also announced Puma is back on the basketball map.

Regardless of how standard Puma’s alleged performance-laden packages for Ayton and Bagley become, it’s clear how disruptive they’ve already been to the performance basketball space.

“When performance has been in fashion, they’ve struggled,” says Powell. “And now that sportswear’s in fashion, they’re winning. And you want to win all the time.”