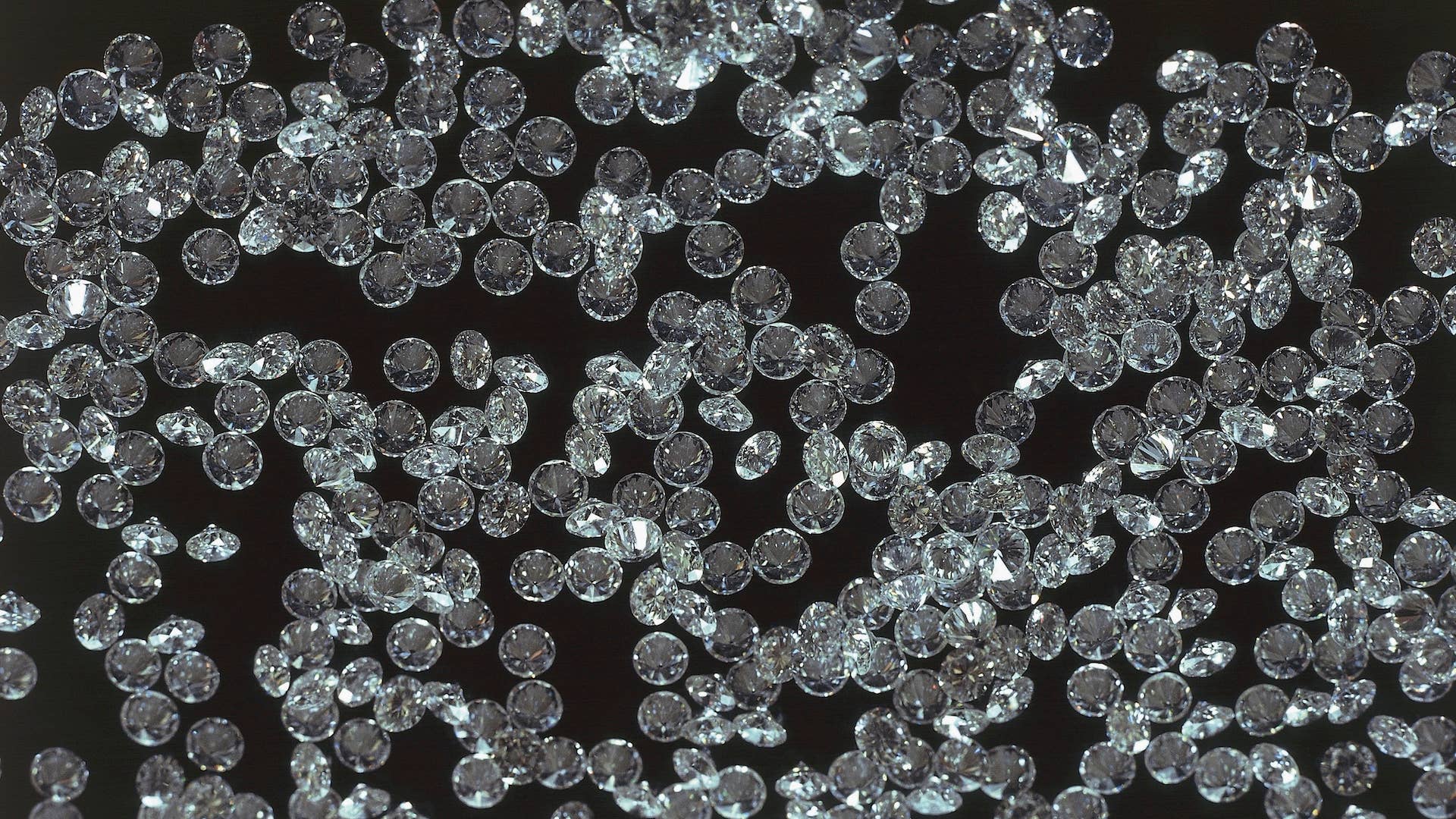

The coronavirus pandemic has left the world with an influx of diamonds. As the world opens back up, dealers now have to figure out how to get rid of their stockpiles without weakening the fledgling recovery.

The global health crisis ravaged the diamond industry, Bloomberg Quint reports. Jewelers have shuttered, artisans forced to stay at home, and sellers like Botswana-based De Beers had to cancel its big yearly March sale because buyers couldn’t travel to view the product.

Though miners declined to slash prices, they permitted buyers the ability to default on contracts to purchase stones. Still, even with reduced production, the diamonds keep mounting. The five largest producers likely have supplies worth $3.5 billion, according to Gemdax, a specialist advisory firm. That number could become $4.5 billion by the year’s end.

“They’ve tried to restrict rough-diamond supply to protect the market and protect value,” Gemdax partner Anish Aggarwal told Bloomberg. “The question will be, how does this destocking occur? Can miners destock and keep protecting the market?”

De Beers ended up canceling its March event, later holding a sale in May. While the company didn’t announce how much it brought in, insiders say the sale generated $35 million, while last year’s earned $416 million. De Beers’ is gearing up for another sale next month, which will be the industry’s next litmus test.

While De Beers’ pricing hasn’t wavered, smaller diamond producers have been reducing prices, with some junior miners marking prices down by 25 percent. That pricing ends up undercutting large companies that are trying to attract big buyers. Diamond miners are now hit with “a double whammy of weak prices and a sharp decline in sales volumes on a scale reminiscent of the 2008-09 crisis,” Societe Generale analyst Sergey Donskoy said. “Can miners destock and keep protecting the market?”

There are some markers of improvement. Chinese retailers have reopened and India has been permitted to resume manufacturing in the Surat polishing hub, though at only 50 percent volume.

Manufacturers bought more during the first two months of 2020, hoping that the market would recover. But now that cutting centers have been closed for the last two months, inventory will stick around until July or August. “At this stage it’s hard to speculate on what the recovery curve will look like,” said Aggarwal. “What we’re not expecting is an immediate jump back in consumer demand.”