A group of investors have filed a lawsuit against FTX founder Sam Bankman-Fried and various celebrities who promoted the crypto exchange following its collapse.

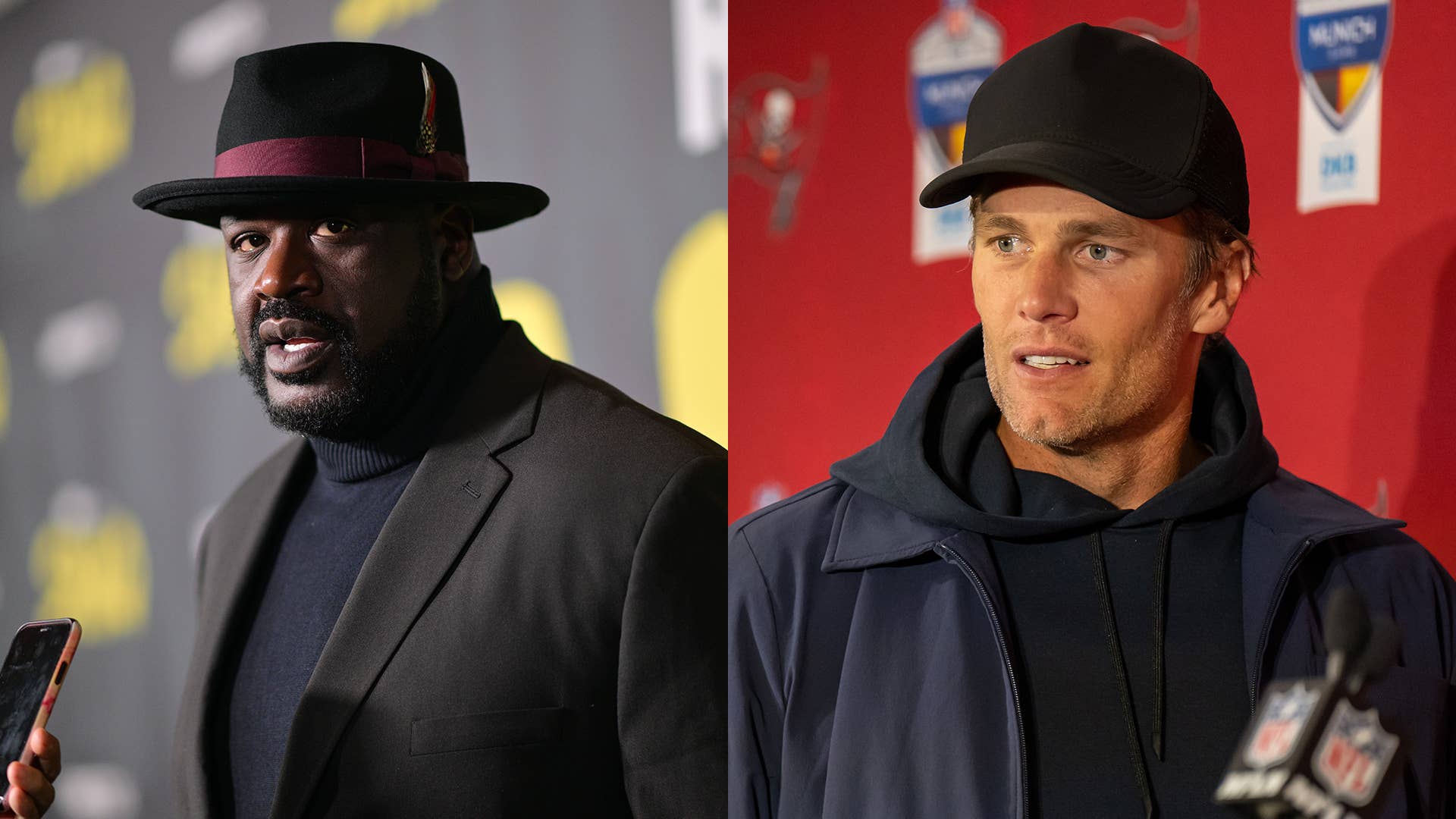

Per crypto publication Decrypt, numerous high-profile celebrities including Shaquille O’Neal, Tom Brady, Steph Curry, and Naomi Osaka have been named in the lawsuit for promoting the alleged “fraudulent scheme” designed “to take advantage of unsophisticated investors from across the country.” Filed by law firm Boies Schiller Flexner and the Moskowitz Law Firm in Florida Southern District Court, the suit comes less than a week after the crypto exchange filed for bankruptcy.

FTX is described as a “house of cards” and “a Ponzi scheme” in the suit, and the company has been accused of “shuffl[ing] customer funds between their opaque affiliated entities.” The plaintiffs assert that as a result of FTX’s activities with investor’s money, “American consumers collectively sustained over $11 billion in damages.”

Among the previously mentioned names, the full list of individuals accused of promoting FTX including supermodel Gisele Bundchen, Kevin O’Leary of Shark Tank, the entire franchise of the Golden State Warriors, and Larry David, who appeared in a Super Bowl ad for the exchange. The parties are being sued because they “controlled, promoted, assisted in, or actively participated in FTX” in some capacity.

"[FTX's business] was based upon false representations and deceptive conduct," the suit reads. "Although many incriminating FTX emails and texts have already been destroyed, we located them and they evidence how FTX’s fraudulent scheme was designed to take advantage of unsophisticated investors from across the country, who utilize mobile apps to make their investments.”

Bankman-Fried apologized for the crash last week, and admitted that he “fucked up” in his handling of the company. FTX crashed after a leaked balance sheet from Bankman-Fried’s quantitative trading firm Alameda Researched allegedly showed that a good chunk of the company’#s assets were denominated in tokens created by FTX itself, prompting regulators to investigate. Not long after, FTX’s biggest competitor Binance announced plans to sell off most FTX tokens from 2021, which led to a huge drop in price for the respective tokens. Bankman-Fried asked Binance for a bailout, and they agreed before backing out after evidence showed FTX had “mishandled corporate funds.”