Managing debt is something we all have to learn how to do, and a lot of people learn the hard way. A lack of understanding about compound interest and how credit card debt works can easily lead to the kind of crippling debt that takes over your life. But it doesn’t have to be that way. Canadian financial tech startup, Lendful wants to help educate Canadians about the risks of buying on credit.

“We have warnings on cigarettes, we now have calorie counts on fast food, but when it comes to credit cards, there is literally nothing out there warning Canadians about the potential pitfalls associated with our ubiquitous ‘buy now, pay later’ mentality,” said Alex Benjamin, CEO of Lendful. “Canadians are drowning in debt, and credit cards account for a huge portion of this issue. It needs to stop.”

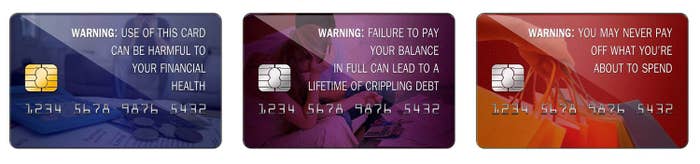

Lendful is proposing that banks should be required to put a warning on all their credit cards so every time a consumer charges a purchase they’re reminded of how important it is that they stay on top of paying off their debt. Possible warnings could include something along the lines of “Use of this card can be harmful to your financial health”, “Failure to pay your balance in full can lead to a lifetime of crippling debt”, and “You may never pay off what you’re about to spend”.

Basically, sugar coating the dangers of using credit without being able to pay it back isn’t helping anyone. Just like the photos of damaged lungs, sick children and rotting teeth on cigarette packs are pulling no punches, these credit card warnings are supposed to be somewhat jarring. If they don’t make people stop and reconsider tapping that card, what’s the point?

Lendful has started a petition on change.org that they plan to send to all the major banks once they’ve collected enough signatures.